SEGMENTATION & PROFILING: Avoid being sucked into the big middle

New products often fail because they target the wrong shopper. More specifically, they target too many different shoppers.

This is called the big middle…and it has the attractive force and survival rate of entering a black hole.

In the vast majority of categories, that big middle is already saturated with general appeal products that offer an assortment of features or benefits designed to appeal to the masses. And the successful products competing in this area rely on the additional support of being recognized brands that invest large marketing budgets to actually attract sales.

A slightly (or even significantly) better product can easily spend its short life lost and unnoticed in this crowd.

WE HELP COMPANIES STAY AWAY FROM THE BIG MIDDLE

To be successful, new products need to do more than offer a compelling benefit or address an unmet need. They must offer the primary benefit or address the top unmet need for a specific group. And then they need to have a marketing message that speaks directly to that specific group where that group will see or hear it.

Most people understand this principle, but get distracted by the enticement of larger sales projections focusing on larger markets.

They forget that gaining just a few points of market share is typically enough to give a product sustainable sales and profit…at least for year one.

Instead, they attempt to attract a larger and more diverse segment, but they get the math wrong:

A small share of a larger fragmented group is NOT easier to gain than a larger share of a smaller cohesive group.

Finding and understanding that right group is segmentation. And it can be done dozens of different ways.

While most approaches are not right or wrong, there can be dramatic differences in how useful and valuable the results are.

Our segmentation models do not follow templates. They are based on studying your particular category, determining what specific factors or attributes are driving core attitudes or behaviors, and building a multi-dimensional algorithm-based model.

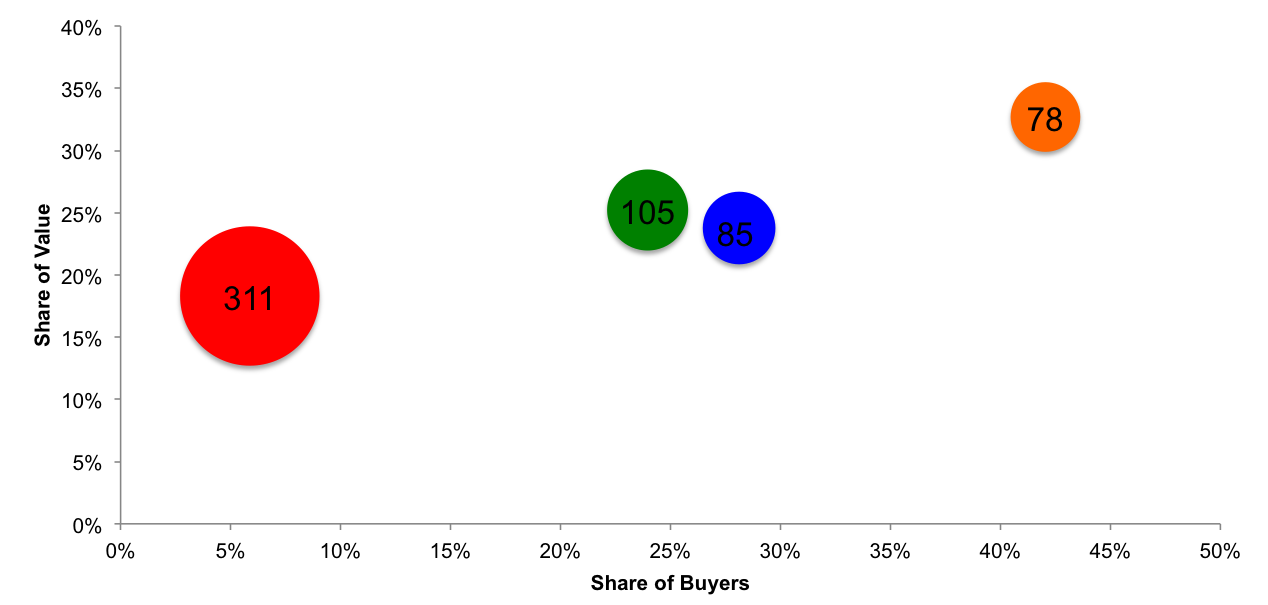

These models typically identify four to six mutually-exclusive segments while providing detailed profile information along with value proxies for each.

The models can be used to segment shoppers, products or retailers and they can even include prospect groups that don’t currently buy the category (a group retailers view as 100% incremental volume to the category).

We’ve used learning from segmentation to help categories realign their thinking and product assortment:

Offering products that emphasize beauty or health benefits (not both) better align with the contradicting priorities of different segments: In at least one category, health-focused buyers view the inclusion of beauty benefits as compromising those health benefits while beauty-focused buyers typically don’t want to pay extra for additional health benefits.

Repositioning a clients product portfolio as convenient & affordable private label versus high quality & durable brands to reflect the different performance expectations and spending thresholds of segments: Casual buyers view this category as disposable (it just needs to work well enough to solve the immediate problem) while weekend warriors will pay for a product to last a lifetime and a brand name they’re proud to be associated with.

Reorganizing a category based on the product variants that actually drove the selection process of different groups: The preference for second-tier attributes were actually more predictive of how shoppers clustered into unique groups. This new knowledge shifted more attention to focus not communicating those second-tier attributes.

If you feel dangerously close to falling into the big middle…let us help discover how to segment your category in a new and useful way. Let us identify and profile the audience that matters most. With this knowledge, you can further refine and refocus and reorganize your product offerings to stand for something special and unique.

Contact us to begin the process.