MISTAKE #18: Your product is really just a share-shifter

Do you know why retailers get excited about new products?

Because new products are a key source of incremental sales growth.

New products help retailers make more money. New products bring new attention or interest. This is their primary reason for being.

Or this is at least what new products are supposed to do.

But there are a lot of new products that fail to do this. They may be unique and exciting and better than existing items, but they don’t deliver incremental sales. All they do is horizontally shift existing sales from other products.

The latest word to describe the act of stealing sales from existing products is conquesting. These products are also called share-shifters, and they are hated.

Share-shifter: A product that, when introduced to a category, does little more than attract current category buyers away from existing items. It brings no new buyers into the category and little or no incremental volume. This is most often caused by the lack of a unique selling proposition or the lack of a marketing program to expand the category consumption or penetration to new users.

You don’t want to be labeled as a share-shifter. They are thieves that not only steal sales from other products, but they steal the buyer’s resources away from other activities that could better help accomplish their objectives of growing sales, profit and turns.

While share-shifting might be considered successful for the owner of the product, it leaves the retailer with little to show for all the time and effort they put into making distribution decisions to grow their category. The product has cost the opportunity of not having a different item in distribution that might have brought incremental sales. And that quickly becomes vulnerable to the buyer’s quest to find products that actually grow sales.

DON’T COME TO THE PARTY EMPTY-HANDED

Retail buyers are constantly looking for ways to grow total category sales and they adding new distribution is a key tactic to bringing that incremental something. New items can do this in three ways, which all relate to the components of volume:

Bring incremental buyers to the category: These could be people that don’t currently buy the category or people that don’t buy the category at a particular retailer. New shoppers are appealing because they always represent 100% incremental sales.

Trade-up current category buyers: Premium-priced products, larger sizes, or multi-packs push up the transaction size while increasing de facto category loyalty to the retailer. This could also include getting purchases that are made in addition to items currently bought, not replacing them.

Increase overall category consumption: While larger sizes can prompt increased consumption (studies show people will take a larger ‘dose’ of shampoo from a liter size bottle than a 100 ml bottle), many products also find success introducing new usage occasions for a category (like thinking of salsa as a cooking ingredient, not just a condiment).

What story can you tell about how your product delivers something incremental? Is it based on demonstrated facts or data? Or is it derived from a subjective perspective or a hope and a prayer? (hint: Buyers don’t make decisions based on hopes and prayers).

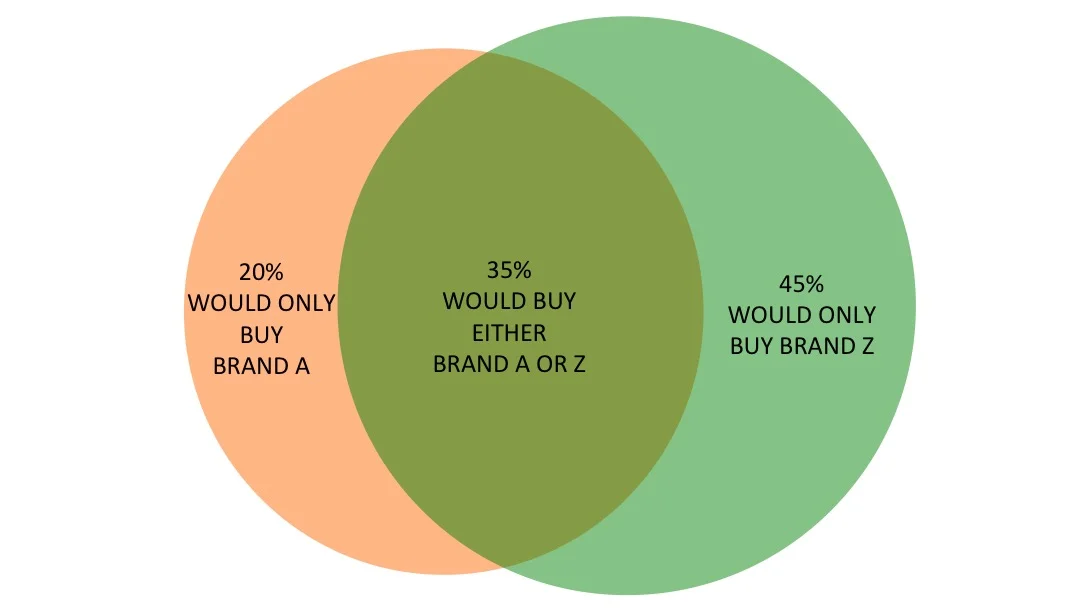

Through techniques like online concept testing, a compelling visual can be created to demonstrate and quantify your product's incremental potential. I’ve seen more distribution decisions based on this one slide in a line review than any other.

In this example, Brand A should not replace Brand Z because Brand Z attracts more unique buyers (45%). There is some risk of cannibalization (35% of buyers would shift between the two brands) which could be a problem if Brand A is sold at a significantly lower price or has a significantly lower profit margin. However, brand A could deliver 20% more incremental shoppers that would not buy Brand Z.

Do you think a buyer gets excited when they see a product with the potential to bring 20% new buyers with it?

Compare that to another example:

In this example, a retailer could replace Brand Z with Brand A. While 80% of shoppers would buy either brand, only 5% of the volume is put at risk (these are shoppers that would only buy Brand Z). However, Brand A should bring more unique or incremental buyers to the category (15%) that more than offset that volume (all else being equal).

Is it a lot easier for a buyer to delete an item when they know only 5% of that item’s volume is at risk?

This same technique can be applied to answering a variety of other key questions your buyer will have. These include guidance on what existing product you recommend for deletion to make room for your product, how to project sales and do a rudimentary volume forecast, and providing a convincing profile of your prime prospect to confirm it aligns with the retailer’s buyer profile.

DO YOUR HOMEWORK

So, how concerned are you about being a share-shifter? What reassuring evidence can you provide that your product will deliver truly incremental shoppers or sales? Does the bigger opportunity lie in figuring out how to reposition your product to be as incremental to the category as possible?

Being able to tell this story will immediately separate you from the majority of other vendors pitching the buyer.

If you’re interested in help or want to learn more about how we tell this story, you just need to ask.