INSIGHT on INSIGHT: Utilizing In-Depth Interviews

WHAT AND WHEN: Proper usage

In-depth interviews focus on a narrow range of topics, but drill deep into all dimensions of those topics to reveal new nuggets or root causes. This information is directional, not factual in nature so it is rarely acted on without additional quantitative validation.

These interviews are sometimes done at the beginning of a multi-phase project (when existing knowledge or decisions have already narrowed the focus). They are also commonly done after extensive quantitative insight has been captured and the need exists to drill deeper into meanings, associations, emotions or perceptions.

These interviews often seek to make sense of various factors that influence a particular observable behavior (like deciding to buy a particular brand or shop a particular store).

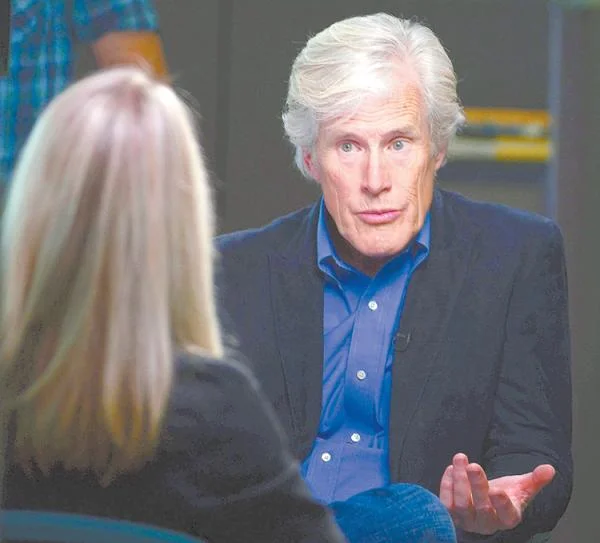

The in-person nature of the interviews also allows for the use of various stimuli in exercises, like existing packaging, new concept renderings, word- or language-based exercises or visual/image/non-verbal exercises.

WHY: The benefit and value

With a strong discussion guide and a talented moderator, in-depth interviews almost always reveal common belief systems or shared factors that manifest in unexpected ways.

Being able to probe into fundamental hopes and fears that drive behavior helps clarify what value proposition a product needs to communicate. This may include:

- Understanding what factors beyond money define “value” for a category

- Understanding what shoppers perceive as indicators of quality for a category

- Exploring how shoppers process the meaning or association of different visual cues

- Identify the attractive or repulse nature of certain words or phrases

HOW: Tips to guide a basic approach

Great interviews come down to asking the right questions in the right way, shutting up long enough for the participant to answer, and asking the right follow-up questions or probes.

Some of the many aspects to consider when conducting in-depth interviews include:

- Establishing a clear focus, but preparing the moderator to recognize where tangents could lead to unexpected insight.

- Structuring the questions to come from a consumer's or shopper's point of view, not a brand manager or sales person.

- Including exercises that do not force participants to rationalize or explain things that may be subconscious.

- Using physical stimuli whenever possible to add a tactile dimension and provide tangible examples for participants to reference.

APPLICATION: What to do with the results

The nature of one-on-one interviews should limit how quickly learning is projected to a larger population. However, practical experience suggests that once an insight has been produced from three separate interviews, it is likely to be broadly applicable.

Just because interview data is not quantitative in nature should not prevent confidentially taking appropriate action. This includes:

- Incorporating the new learning into future quantitative work for validation

- Translating deeper insights into new concepts to further test and refine

- Utilizing stories and sound bites from the interviews to justify or personalize the purpose of projects being pursued.